What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a health insurance plan provided by private companies approved by Medicare. It offers at least the same coverage as Original Medicare – Part A and Part B. But also, Medicare Advantage gives some additional benefits that Original Medicare does not provide.

The most often added benefit is prescription drug coverage (Part D), which is included in almost every Part C plan.

These additional benefits can sometimes be provided at no additional cost to you. This is possible because Medicare actually pays the insurance company a set amount for providing your healthcare coverage.

Medicare Advantage Eligibility

If you are eligible for Medicare, you are eligible for an Advantage plan. You must be enrolled in both Medicare Part A and B before you can purchase a Medicare Advantage plan. And you cannot drop Part B. If you do so, you will lose your Advantage plan.

Medicare Advantage Enrollment

It's crucial to know when you can sign up. Here's when you can enroll in a Medicare Advantage plan:

Initial enrollment period — Your initial enrollment period is a seven-month period that starts three months before the month you turn 65 and ends three months after the month you turn 65. If you are under 65 and receive Social Security disability, you qualify for Medicare in the 25th month after you begin receiving your Social Security benefits. If that is how you are becoming eligible for Medicare, you can enroll in an Advantage plan three months before your month of eligibility until three months after you became eligible.

Open enrollment period — Also known as annual enrollment or AEP, the open enrollment period for Medicare Advantage is from October 15 through December 7 every year. Coverage for the Part C plan you choose during this time will start on January 1 next year. During this time, you can also add, change, or drop current coverage.

Medicare Advantage Open Enrollment Period — During this MA Open enrollment period, you are able to change from one Advantage plan to another or drop it to return to Original Medicare.

Special Election Period — There are several things that can trigger a special election period and they are unique to an individual. It is best to speak to a licensed Medicare insurance agent to find out if you qualify for a special election period. However, there are a few common instances we can talk about. Such as, if you move outside your Medicare Advantage plan’s service area, qualify for extra help (such as a program that helps pay for your prescription drugs), or move into a nursing home you might qualify for a special election period. During this time, you can make changes to your Advantage plan or return back to Original Medicare.

Medicare Advantage Coverage & Benefits

There are a few extra benefits that Medicare Part C can cover, but Original Medicare does not.

Medicare Advantage Costs

Medicare Part C costs are determined by several factors, such as premiums, deductibles, copayments, and coinsurance. These amounts can range from $0 to hundreds of dollars for monthly premiums and yearly deductibles. But most of your Part C costs will be determined by your chosen plan.

Here below are some of the most common factors affecting Part C plan cost:

Premiums: Some Medicare Part C plans are free, meaning they don’t have a monthly premium. But even if it is a $0 premium, you may still owe the Part B premium.

Deductibles: Most Medicare Part C plans have both a plan deductible and a drug deductible. Some of the free Medicare Advantage plans offer a $0 plan deductible.

Copayments and coinsurance: Copayments are amounts you will owe for every doctor’s visit or prescription drug refill. Coinsurance amounts are any percentage of services you must pay out of pocket after your deductible has been met.

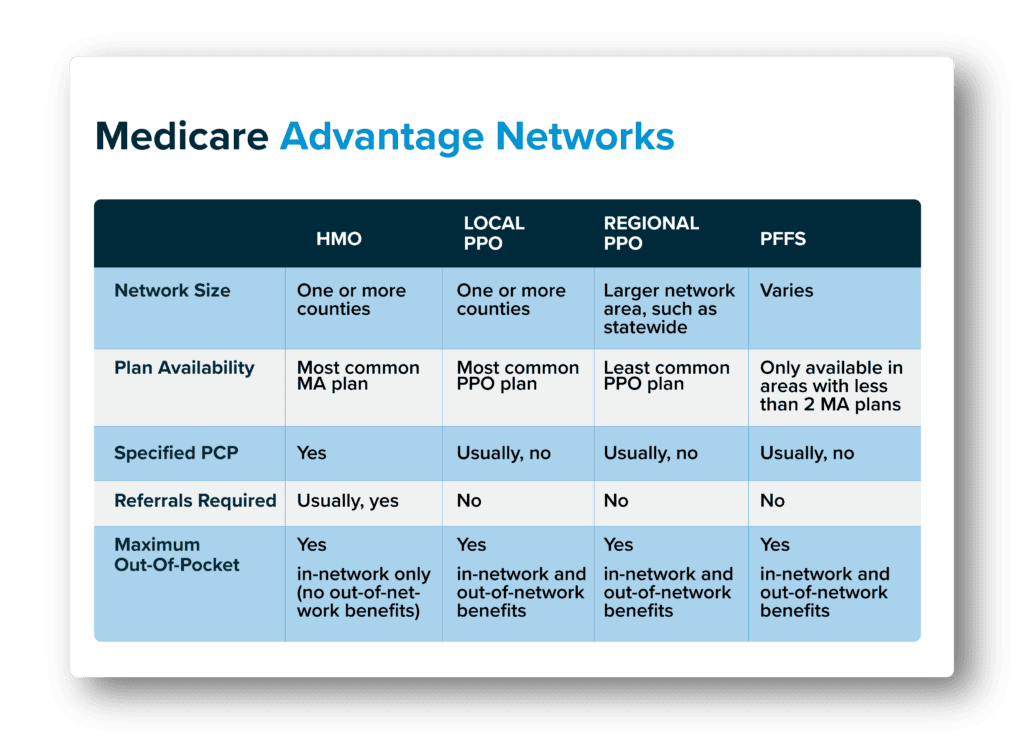

Plan type: The type of plan you choose can also have an impact on how much your Part C plan may cost.

Out-of-pocket maximum: One advantage of Medicare Part C is that all plans have an out-of-pocket maximum.

Don't Risk Getting the Wrong Coverage

It's Quick and

No Obligation!

We can help you find the most affordable plans in your area. Let us help you take the guesswork out of choosing a plan.

Medicare required disclaimer: We may not offer every plan available in your area. Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program (SHIP) to get information on all of your options.